When it comes to buying or developing commercial property, an accurate land survey is critical. Among the most trusted tools in the industry is the ALTA survey—a standardized, in-depth report that protects buyers, lenders, and insurers from surprises.

Let’s break down what an ALTA survey really is, how it works, and when it’s required.

The Basics: What Is an ALTA/NSPS Survey?

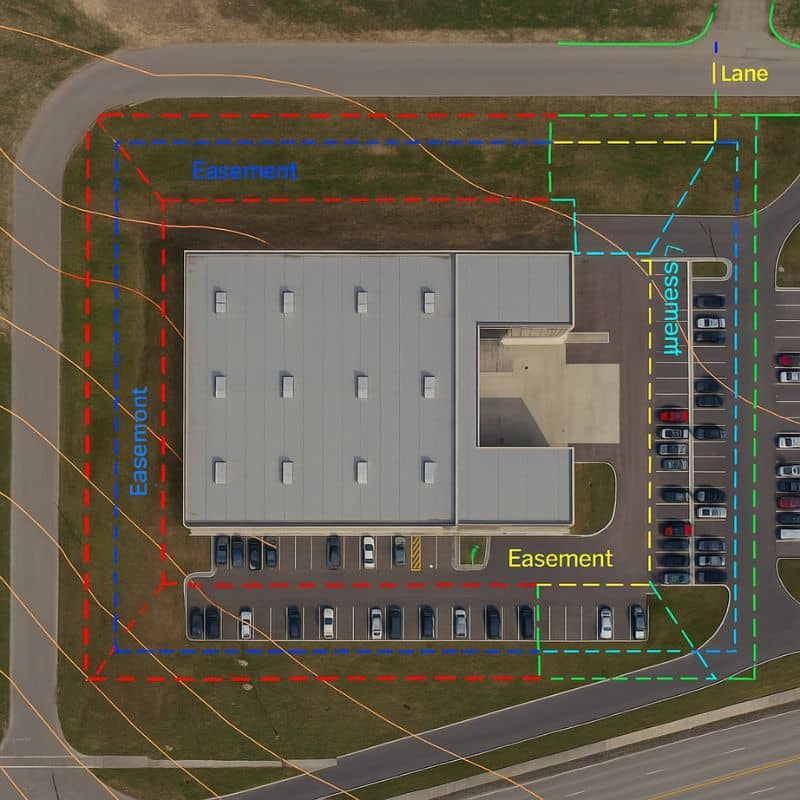

An ALTA/NSPS Land Title Survey is a detailed land report that shows the legal boundaries of a property, along with any features that could affect ownership or development.

It’s created using national standards from two groups:

- ALTA – American Land Title Association

- NSPS – National Society of Professional Surveyors

Think of it as a property blueprint that includes not just the lines, but everything happening on, under, and around the land—useful when millions of dollars are on the line.

What Information Does an ALTA Survey Include?

ALTA surveys go far beyond a basic plot map. Here’s what they typically include:

- Exact property lines and corners

- Access points, like driveways or alleys

- Structures on the land (buildings, fences, signs)

- Easements, such as utility rights or shared driveways

- Utilities (above-ground and sometimes underground)

- Encroachments from nearby properties

- Flood zone status (if requested)

The purpose? To confirm the property is free of hidden issues that could disrupt development or financing.

When Is an ALTA Survey Needed?

You likely need an ALTA survey if you’re:

| Scenario | Is ALTA Survey Needed? |

| Buying commercial real estate | ✔ Yes |

| Securing a commercial loan | ✔ Yes |

| Updating title insurance | ✔ Yes |

| Building new structures | ✔ Often |

| Buying residential property | ✘ Not usually |

It’s most often required by lenders or title insurers as a condition of closing.

Who Uses ALTA Surveys?

- Lenders – To secure the value of their loan with accurate data

- Title insurance companies – To identify and insure against potential risks

- Attorneys – To confirm zoning, access, and legal use

- Developers and investors – To verify the land supports their plans

- Buyers – To avoid purchasing land with surprises

Customizing the Survey: What Is Table A?

Each ALTA survey can be tailored using something called Table A—a list of optional items the buyer or lender can request.

These extras might include:

- Locations of underground utilities

- Count of parking spaces

- Building height or square footage

- Topography or slope mapping

- Proximity to flood zones

Selecting the right Table A items ensures the survey aligns with the project’s goals.

ALTA vs. Other Survey Types

Not sure how this compares to other land surveys? Here’s a quick look:

| Survey Type | Focus | Best For |

| Boundary Survey | Property lines only | Fence, lot divisions |

| Topographic Survey | Elevation, terrain features | Site planning, drainage |

| ALTA Survey | Legal, physical, and title concerns | Commercial deals, financing |

How Long Does It Take? What Does It Cost?

An ALTA survey can take anywhere from 1 to 4 weeks, depending on the site size and the number of Table A items requested.

Typical cost:

- Small commercial lot: $2,500 – $4,000

- Larger or complex property: $5,000+

Factors that affect pricing:

- Property size

- Terrain or building complexity

- Location

- Title research required

Key Benefits of Ordering an ALTA Survey

- Protects buyers from hidden legal issues

- Builds confidence for lenders and insurers

- Reduces risk of future disputes

- Provides reliable data for zoning and permits

- Speeds up real estate closings

Final Thoughts: Why It Pays to Get One Early

An ALTA survey isn’t just a box to check—it’s a powerful planning tool that safeguards your investment and keeps your deal on track.

Whether you’re a developer, investor, or business owner, knowing exactly what you’re buying is the first step to a smart, smooth transaction.